You know your car’s going to be expensive. There’s no getting around it. Even older cars tend to be some of the most expensive assets you’ll ever own and the costs don’t stop once you have the car. Getting the best deal at the start means considering the lifetime of costs that will come with the car. So here are most of the major costs you need to navigate.

Get your money settled first

This is where you’re going to make the biggest dent in how much exactly you pay for the car, to begin with. Take the time to look at your credit and make any necessary repairs you can, such as removing errors from your report. Take your time scanning what different creditors are willing to offer. That’s how you get the best car loan deals. When you have the loan that works for you, you know exactly what range of car you can afford and how long it will take you to pay it off.

Beware the salesman

You might think you would get the best deal from a dealership. It’s in the name, after all. However, unless you’re prepared to be a savvy negotiator, it might be best to avoid them in total. They are more than happy to get you signing for extras that you could just as easily and more cheaply get elsewhere. To avoid getting ripped off, do your research on what you’re looking for beforehand and what prices those cars tend to go for, as well as which extras you’re likely to get offered and where to get a better deal on them.

Know the ins-and-outs of your insurance

Car salespeople aren’t the only ones more than happy to sell you something you don’t need. Auto insurance is mandatory if you plan on driving, but all the little provisions that come with your agreement might not be as essential. For instance, you likely don’t need comprehensive insurance if you’ve got a car that is at very little risk of ever getting stolen. Just as you might not need insurance that allows you to drive any car if you only have one vehicle in the family and no company car.

Not all cars run equally

You might think that you can afford a car based on the initial purchase price, but don’t forget the lifetime costs of it as well. For instance, a larger engine might be tempting, but it’s also going to cost more fuel to run. Similarly, you might think an inexpensive car is a smart choice, but have you considered how reliable it is and how likely you are to have to spend on repairs more often? The costs of fuel and the likelihood of needing repairs and replacements should figure majorly into your choice of car.

A “cheap” car isn’t necessarily going to be inexpensive to keep running. A dealership isn’t the place you’ll necessarily get the best deal. These are just a few of the factors that impact the overall costs of the car but following the advice above alone can already make major cuts in how much your vehicle costs you.

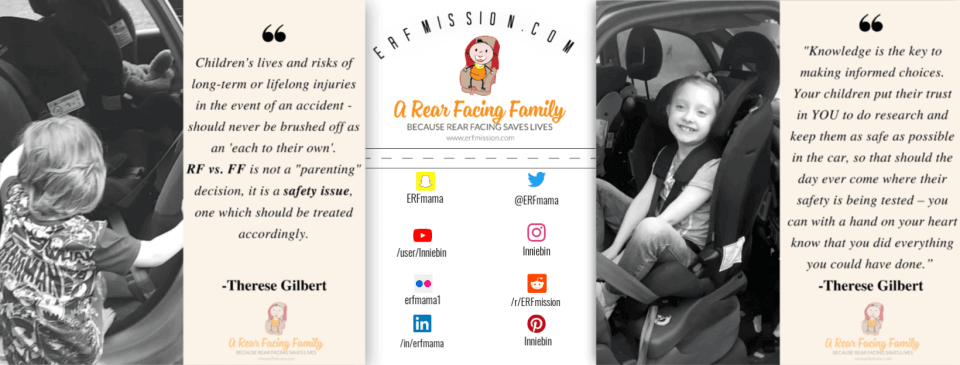

Therese has completed the ‘Advanced Child Car Seat Training Course’ at TRL (Transport Research Lab) and is a CPD accredited car seat expert. She blogs about in-car safety, car seats, tips, reviews, giveaways and advice. She’s a mum on a mission to change the law and raise awareness. She is also a breastfeeding advocate and gentle parenting promoter who loves cloth nappies, baby-wearing, BLW and co-sleeping/bed-sharing.